Automotive Supplier Challenges for Success in a Constant Disruptive Environment

Vice President – Vehicle & Powertrain Group, S&P Global Mobility

In automotive supplier sales, various key factors are essential to winning new and profitable business. These success factors have not changed in the past 25 years; however, the disruptive nature of the recent market environment magnifies the exposure if those challenges are not addressed.

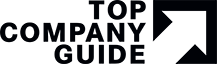

Mature markets such as North America, Europe or Japan / Korea have already seen peak production and long-term incremental production volume growth can only be expected from markets like China, India, ASEAN markets and to a lessor extent South America. Geopolitics, economics, technology dependencies and a pandemic are heavily disrupting status quo.

And on top major carmakers are tilting their entire strategy strongly towards electrification within two years. By 2030 S&P Global Mobility forecasts that 50% of globally produced light vehicles will be battery electric. The speed of change is unprecedented and there is no slowdown in sight.

As S&P Global Mobility, formerly the automotive team at IHS Markit, we are central to the global automotive planning processes across the entire value chain. We provide data and intelligence powering our industry. But data itself is just one success factor. The usage and integration to drive workflows and strategic decision making, is as critical. Speaking with thousands of our supplier customers in sales, management, and supply chain, understanding their workflows and pressure points, we identified the following 5 challenges for automotive supplier sales.

1. Lack of market analysis

2. Lack of operationalization

3. No regular review and adjustment

4. Lack of focus

5. Nontransparent acquisition process

From the supplier perspective, the focus is of course on profitable growth. Sales makes a significant contribution to this by bringing the right orders into the company and ensuring profit increases through change and claim management. But that is just one side of the medallion. It is no less important to digitalize your processes and move into a sustainable and purpose built planning environment that does not rely on spreadsheets.

Especially the recent years of constant change showed that processes of forecasting and storing data in Excel are not sustainable anymore.

The problem of »too few, too many or the wrong orders«

When it comes to new orders, the crucial question is which orders and how many, in which regions, in which plants, with which products, with which customers make the most sense for your business? The point is to get not just any orders, but the right orders. If too few, too many or the wrong orders are won, there will be consequences.

– Too few orders can lead to underutilization in the plants, in the project teams and to insufficient contribution margins for overhead. The negative impact on profitability is clear to everyone.

– Too many orders are not much better. Suppliers with too few resources to professionally process orders create dissatisfied customers, overworked employees and can quickly find themselves in financing problems.

– Orders that do not correspond to a strategy defined according to market or resource criteria are counter-productive and are therefore the wrong orders for the company.

The reality is, that many automotive suppliers lack processes or mechanisms to operationalize strategy and verify implementation. Overcoming the five key challenges will be critical. Our assessment is as follows:

1. Lack of market analysis

The foundation for a successful strategy is a best-in-class data asset to mirror your internal assumptions. Planning without a second opinion is grossly negligent given the size of investments that must be made. However, a strategy definition that is disconnected from market developments cannot be successful either. Just to provide an idea of complexity, in the next 5 years, approximately 1.700 all new vehicle programs in about 600 plants around the world will be launched. Therefore, both the strategy definition and the operationalization must be linked to concrete market data in order not to operate in illusory worlds.

2. Lack of operationalization

All new carmaker product strategies are challenging established segment patterns. What used to be a safe bet and the best for your business might not exist in two to three years. A mid-size supplier has no chance to keep track of all the product changes and its implications by themselves. Without an external intelligence feed the key turning points of the industry shift will be missed. And missing operationalization or operationalization that is not aligned with the strategy is another widespread problem. Concrete target projects are critical – having a plan for which products you’ll supply to certain vehicles or engines, are often missing or do not fit the strategy. As a result, the acquisition process is thus not guided by strategy, but often driven by opportunity.

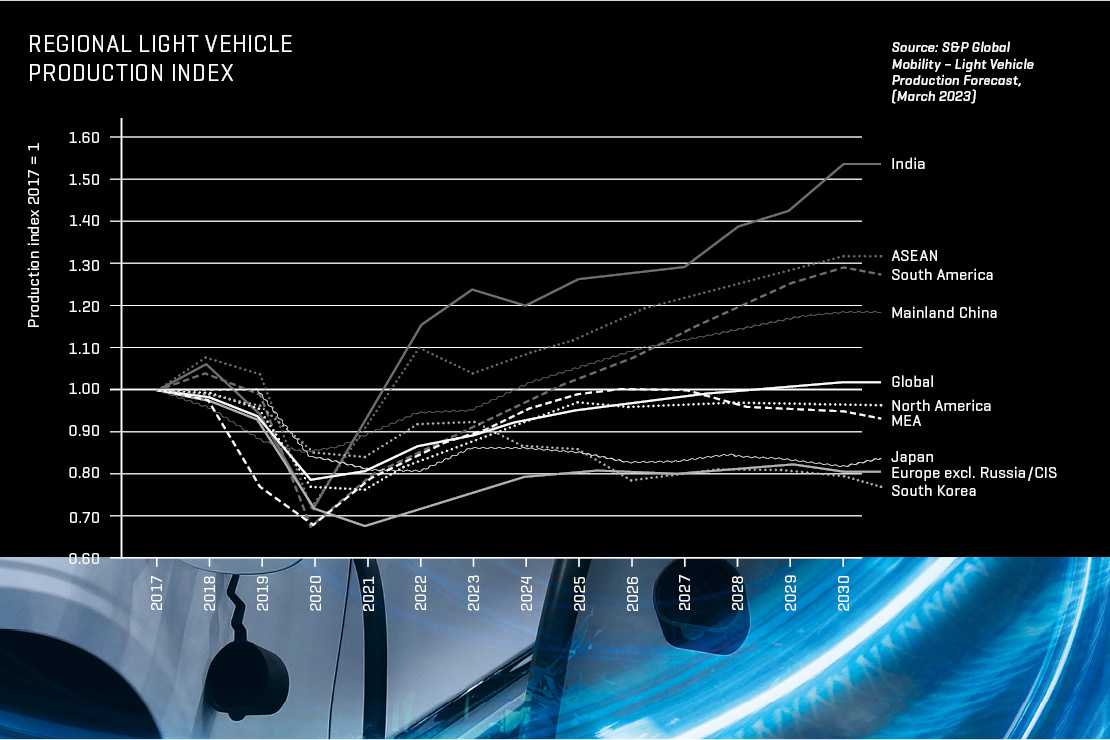

3. No regular review and adjustment

For many suppliers, the strategic planning process is limited to once-a-year meetings. This approach can be fatal in a dynamic world such as we are currently experiencing. A forecast, internal or external, is in these unstable times already outdated short after its release. Constant rolling planning is needed, which very often gets lost in infinitely complex spreadsheets with inadequate evaluation options to identify undesirable developments. A continuous review and adjustment possibility of the strategy with changing conditions is missing.

4. Lack of focus

No or too little focus on the agreed (operationalized) strategy prevents the implementation of the planned alignment. For target projects to be successfully won, a focus of all functions on these projects is necessary. A systematic approach is necessary.

5. Nontransparent acquisition process

An intransparent acquisition process that is not synchronized with the strategy leads to orders that are opportunity-driven and not guided by a strategy.

But what can an automotive supplier do to win the right orders?

There is a critical need for clearly structured processes that address each of the above problem points. Consistency, depth of detail, transparency, KPI’s and real-time information are the success parameters. These are needed from the market observation to the strategy to the concrete acquisition project. Top line management-ready reports that enable continuous success monitoring which keeps the company on track should be considered.

The issue has complexity, of course, but that’s what digitization was invented for. Each of the problems mentioned can be eliminated via an automotive supplier-specific software solution. A standard CRM system will not be supportive to these industry specific requirements. Whoever relies on the right solution here has the best prerequisites for winning the right orders in the future.

S&P Global Mobility offers clients end to end solutions. From market intelligence to digital integration, benchmarked workflows and automized reporting. Reach out to us to discuss how we can help your team take your business to the next level.